Life Insurance Louisville Ky Fundamentals Explained

Table of ContentsWhole Life Insurance Louisville Things To Know Before You Get ThisNot known Facts About Life Insurance Louisville KyTop Guidelines Of Life Insurance CompanyWhat Does Life Insurance Louisville Ky Mean?Facts About Whole Life Insurance Uncovered

Life insurance policy offers monetary defense for the individuals you respect. You pay a regular monthly or annual costs to an insurer, and also in exchange the business pays a tax-free round figure of money to your recipient if you pass away while the policy is active. You can personalize your life insurance coverage policy to fit your family members's demands by selecting the sort of plan you get, the number of years you want it to last, and also the quantity of cash paid out - American Income Life.Life insurance policy is a really common asset that figures right into lots of people's long-term economic planning - Life insurance quote online. Getting a life insurance policy policy is a means to shield your loved ones, offering them with the monetary support they might require after you die. For instance, you may acquire life insurance policy to aid your spouse cover home mortgage payments or day-to-day costs or fund your kids's university education.

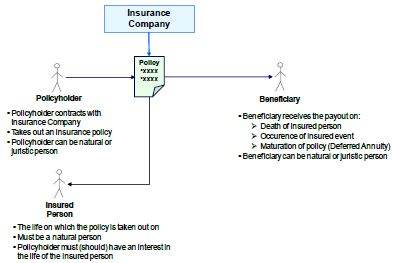

This can assist with picking a payment choice that functions best for your estate planning objectives. Key Takeaways Life insurance is an agreement between a policyholder and also an insurer that's developed to pay out a survivor benefit when the insured person dies (Senior whole life insurance). A life insurance policy business need to be called asap complying with the death of the guaranteed to begin the insurance claims and payment procedure.

Rumored Buzz on Cancer Life Insurance

There are different ways a recipient may obtain a life insurance policy payout, consisting of lump-sum repayments, installment repayments, annuities, and also retained asset accounts. See Currently: What Is Life insurance policy? Life Insurance coverage Basics Life insurance coverage is a kind of insurance contract. When you buy a life insurance policy policy, you concur to pay costs to maintain your protection undamaged.

Some life insurance coverage policies can offer both death advantages and also living benefits. A living benefit motorcyclist allows you to take advantage of your policy's death advantage while you're still to life. This sort of cyclist can be helpful in circumstances where you're terminally unwell and need funds to pay for healthcare.

These policies allow the policyholder to be the recipient of their very own life insurance policy plan," says Ted Bernstein, owner of Life process Financial Planners LLC. When acquiring life insurance coverage, it is essential to think about: Just how much coverage you need Whether a term life or long-term life plan makes more sense What you'll spend for costs Which motorcyclists, if any, you wish to consist of The distinctions between life insurance policy estimates for every prospective plan In terms of coverage quantities, a life insurance policy calculator can be valuable in selecting a death advantage.

The Basic Principles Of Life Insurance

Life insurance coverage premium prices can depend on the type of policy, the quantity of the death benefit, the cyclists you consist of, and your general wellness.

Minor children can not be called as recipients of a life insurance policy. Submitting a Claim Death benefits are not paid out immediately from a life insurance coverage policy.

Some Known Factual Statements About Cancer Life Insurance

There's no collection target date for just how lengthy you have to submit a life insurance coverage case yet the sooner you do so, the far better. When Benefits Are Paid Life insurance policy advantages are commonly paid when the insured party dies. Beneficiaries submit a fatality case with the insurance provider by submitting a qualified duplicate of the death certification.

If a business refutes your claim, it generally supplies a factor why. A lot of insurance policy companies pay within 30 to 60 days of the date of the claim, according to Chris Huntley, owner of Huntley Wealth & Insurance Policy Solutions.

The Best Strategy To Use For Child Whole Life Insurance

The factor: the one- to two-year contestability condition. "A lot of policies include this stipulation, which allows the carrier to investigate the initial application to make sure scams was not dedicated. As long as the insurer can not verify the insured pushed the application, the advantage will usually be paid," states Huntley.

If you or someone you understand is experiencing from depression or go to these guys psychological wellness concerns, get assist now. You are not alone. If you or a loved one is pondering suicide, get in touch with the National Self-destruction Avoidance Lifeline at 1-800-273-8255 or through live chat. It's available 24 hr a day, 7 days a week, and also gives free as well as private support.